📉 Bitcoin Closes Fourth Consecutive Red Month

Bitcoin logged its fourth straight monthly red candle, extending a correction that has tested conviction across the market. While price weakness often fuels bearish narratives, longer-term indicators still point to structural strength beneath the surface.

Historically, extended red streaks have occurred during transitions not endings, especially when liquidity and policy dynamics are shifting in Bitcoin’s favor.

🏛️ Trump Appoints Pro-Bitcoin Fed Chair Kevin Warsh

Donald Trump announced Kevin Warsh as the next Federal Reserve Chair, marking the first openly pro-Bitcoin figure to hold the role. Warsh has publicly acknowledged Bitcoin’s monetary relevance, signaling a sharp departure from the Fed’s historically hostile stance.

This appointment alone reshapes expectations around monetary policy, regulation, and Bitcoin’s role in the global financial system.

💵 Trump Confirms Plan to Devalue the U.S. Dollar

Trump also confirmed plans to pursue a weaker dollar as part of broader economic strategy. While framed as a competitiveness move, dollar debasement historically pushes capital toward scarce assets.

For Bitcoin, the implication is simple: currency dilution reinforces the case for a fixed-supply monetary alternative.

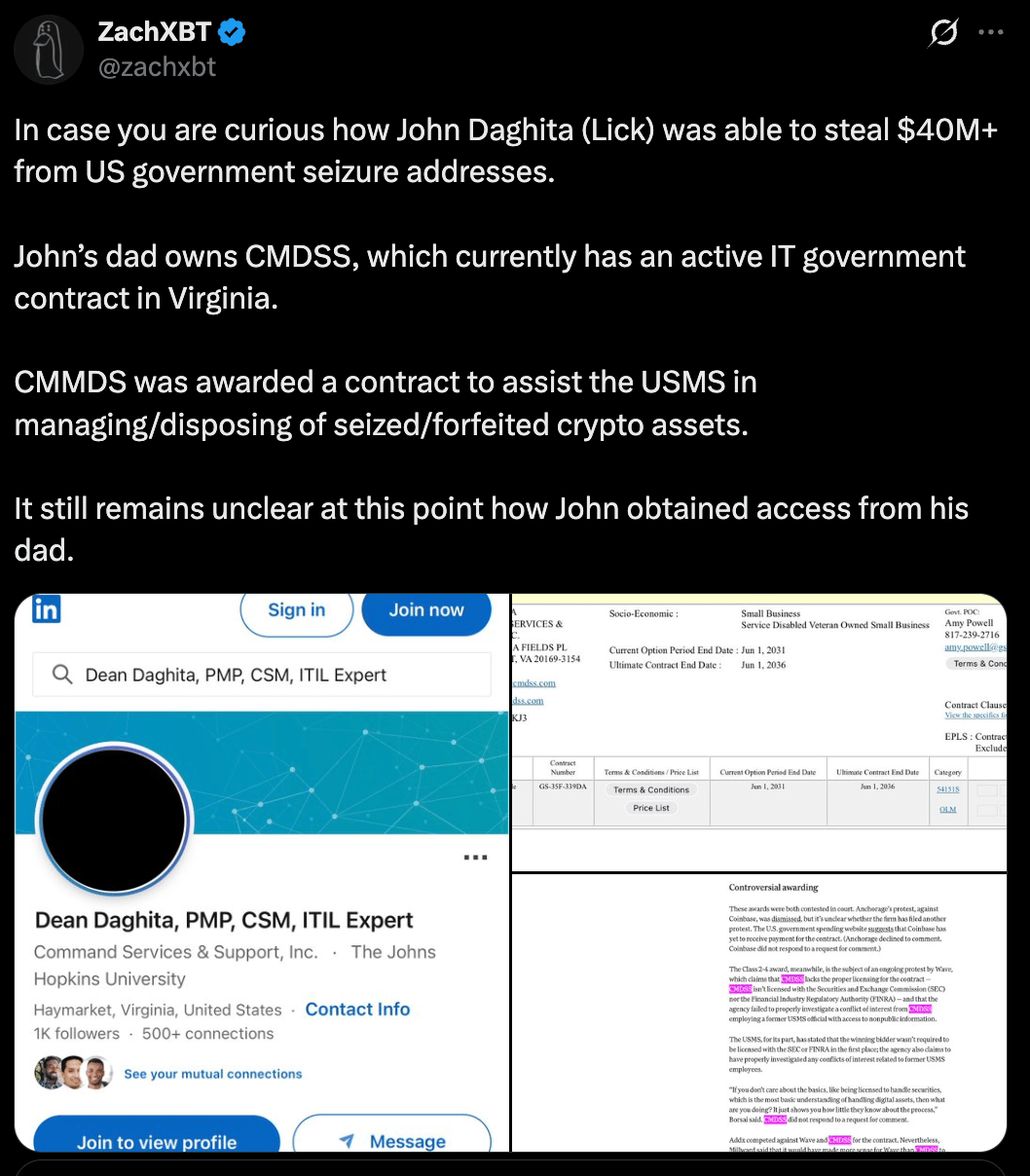

🚨 $40M in Bitcoin Stolen From Strategic Reserve?

Reports surfaced alleging that over $40 million in Bitcoin tied to U.S. government seizure wallets may have been stolen. The situation highlights vulnerabilities in third-party custody and asset management tied to forfeited crypto.

If confirmed, it would underscore Bitcoin’s core lesson yet again: custody is destiny, even for governments.

📜 U.S. Senate Committee Passes Digital Asset Market Structure Bill

A key Senate committee advanced the long-awaited digital asset market structure bill, moving the U.S. one step closer to regulatory clarity. The bill aims to define oversight roles and reduce uncertainty that has plagued the industry.

While not law yet, this marks meaningful progress toward a rules-based framework instead of regulation by enforcement.

VIDEO OF THE WEEK

This is not Bitcoin going up. This is the dollar breaking down in real time. A deliberately weak dollar is inflating asset prices, masking collapse, and setting the stage for an explosive Bitcoin move. Once you see the signal, you cannot unsee it.