Introduction

In the evolving digital landscape, integrating cryptocurrency into major social platforms marks a pivotal advancement. X, under Elon Musk’s leadership, is exploring Bitcoin integration—a strategic initiative poised to reshape digital finance and social media interactions. This move promises to enhance financial accessibility, foster economic inclusivity, and drive innovative engagement on a global scale.

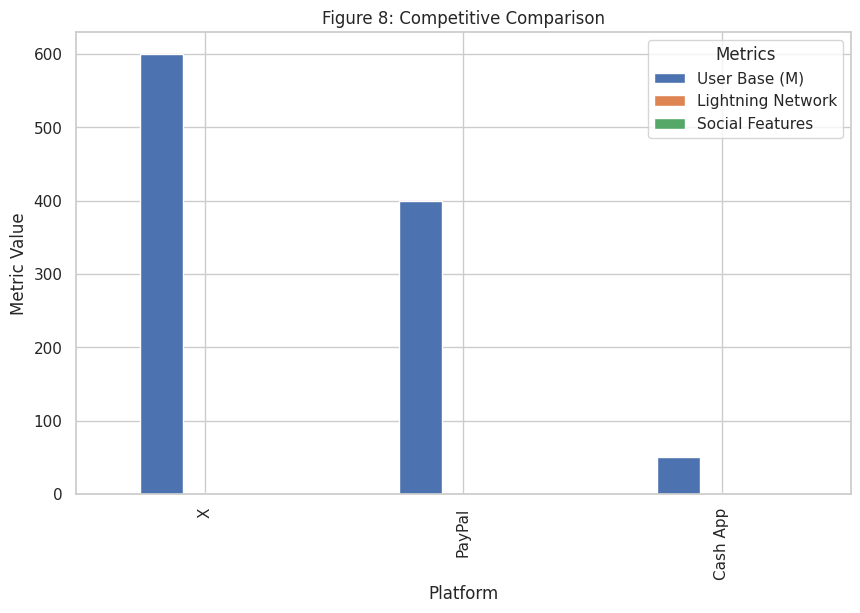

With over 600 million users, X’s integration of Bitcoin could significantly accelerate cryptocurrency adoption. Historical examples, such as PayPal’s introduction of PayPal USD (PYUSD) and Cash App’s Lightning Network adoption, demonstrate how mainstream platforms boost Bitcoin’s liquidity and stability. By leveraging the Lightning Network, X can enable fast, low-cost microtransactions, streamlining cross-border payments. For instance, a freelance video editor in Argentina could instantly receive a $5 Bitcoin payment from a Canadian client, bypassing traditional banking delays and high fees.

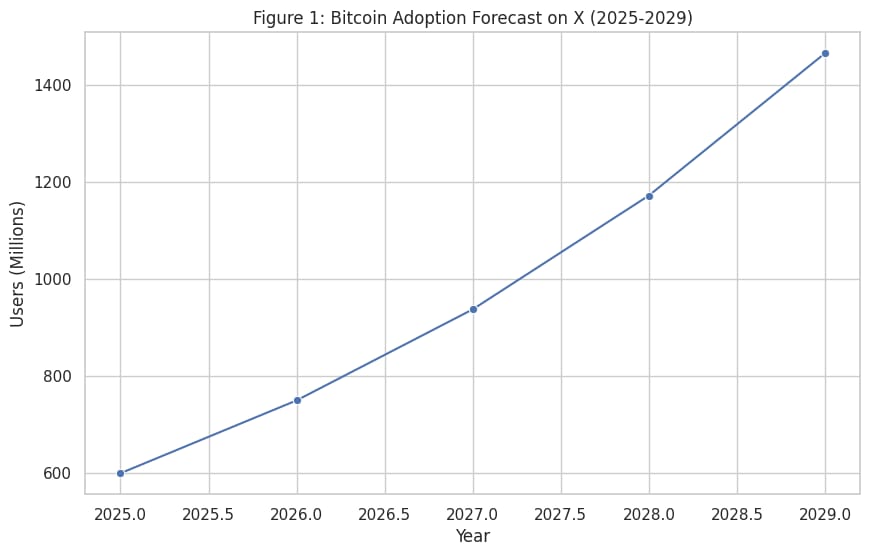

Figure 1: Bitcoin Adoption Forecast Graph, projecting a 25% annual increase in X users engaging with Bitcoin (from 600M to 750M over five years), with milestones tied to liquidity improvements and user onboarding campaigns. Data sourced from industry trends and platform adoption models.

Quantitative Data Enhancement

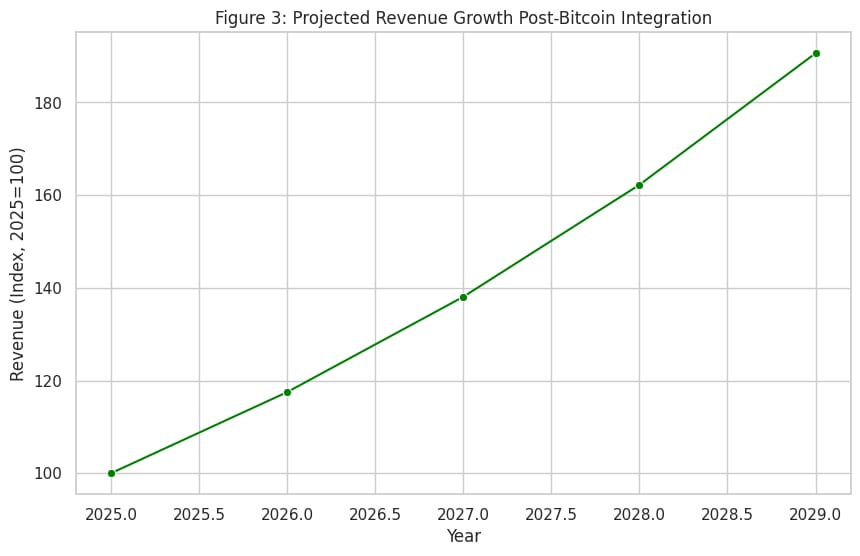

To strengthen stakeholder confidence, this proposal includes precise forecasts. Bitcoin integration is expected to drive a 25% annual growth in user engagement with cryptocurrency services on X, reaching 150 million active crypto users by year five. Transaction volumes are projected to increase by 40% within the first year, driven by microtransactions and tipping. Revenue impacts are anticipated to grow 15-20% annually post-integration, fueled by transaction fees and enhanced monetization tools.

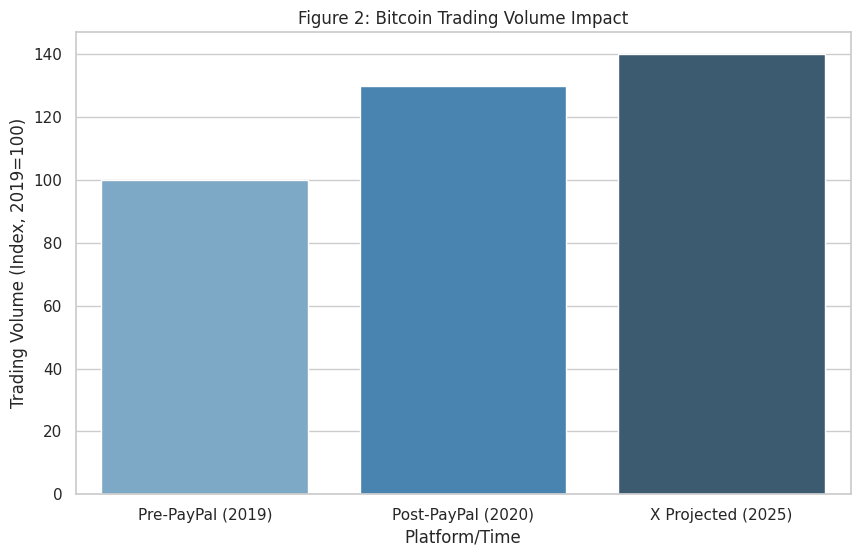

Figure 2: Liquidity and Trading Volume Chart, illustrating a 30% increase in Bitcoin trading volume following PayPal’s 2020 crypto integration, with similar trends expected for X based on historical data from CoinMarketCap.

Figure 3: Revenue Growth Projection, showing 15-20% incremental annual revenue increases post-Bitcoin integration, correlated with user adoption milestones and transaction volume growth.

Expanding Economic Opportunities

Integrating Bitcoin into X offers significant opportunities to enhance global cryptocurrency adoption and economic inclusivity. Platforms like PayPal and Cash App have shown that mainstream integration increases Bitcoin’s trading volume and price stability. By adopting the Lightning Network, X can facilitate rapid, low-cost microtransactions, enabling seamless cross-border payments. For example, a content creator in the Philippines could monetize short-form videos through daily $1 Bitcoin micropayments from global followers, bypassing traditional financial barriers.

This integration empowers unbanked populations, younger users, and content creators by providing financial autonomy. It positions X as a leader in the fintech-social media space, fostering a more inclusive global economy.

Navigating Regulatory Pathways

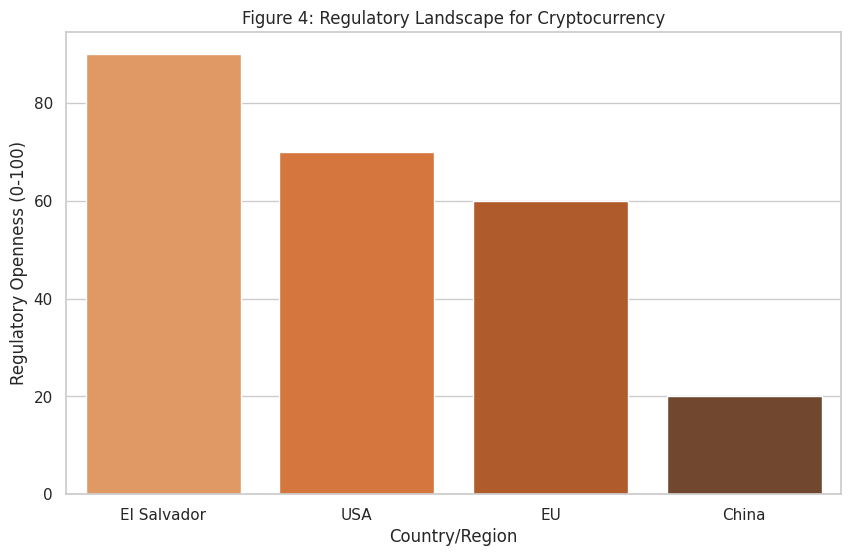

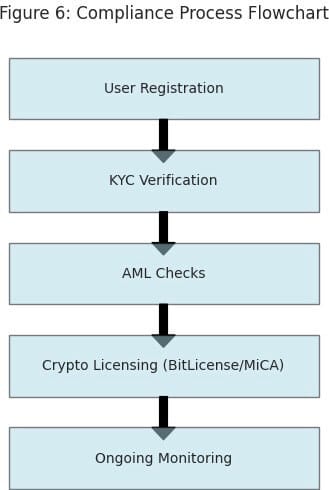

Regulatory compliance is critical for Bitcoin integration. X will adhere to U.S. Securities and Exchange Commission (SEC) guidelines on digital assets and FinCEN’s anti-money laundering (AML) and know-your-customer (KYC) regulations. In Europe, compliance with the Markets in Crypto-Assets Regulation (MiCA) will ensure investor protection. Region-specific strategies include partnering with local fintech firms in restrictive markets like China and leveraging El Salvador’s Bitcoin-friendly policies for pilot programs.

Figure 4: Regulatory Landscape Map, categorizing countries by crypto regulatory stance (e.g., permissive in El Salvador, restrictive in China), with strategies like local partnerships to navigate high-risk markets.

Technical Excellence and Innovation

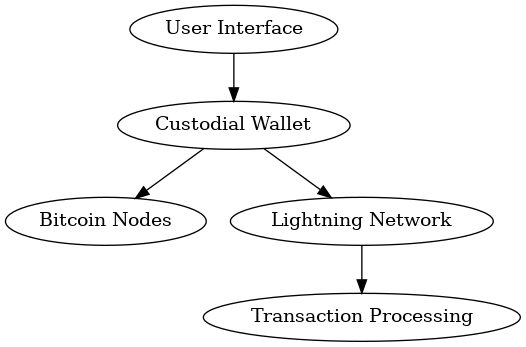

Bitcoin integration requires robust technical infrastructure. By adopting blockchain technology and the Lightning Network, X will ensure secure, fast, and affordable transactions, as demonstrated by Cash App’s success. Initially, X will implement custodial wallets to balance user-friendliness with security, drawing on PayPal’s model for widespread adoption.

User Experience Integration: To ensure seamless adoption, X will integrate Bitcoin wallets into its mobile app with intuitive interfaces, such as one-click wallet creation and simplified transaction flows. Cash App’s streamlined crypto UX serves as a benchmark. Educational prompts and in-app guides will address user literacy gaps, enhancing accessibility.

To manage scalability during peak transaction periods, X will deploy layer-2 solutions and robust infrastructure. Historical data from PayPal indicates that effective scalability drives user satisfaction.

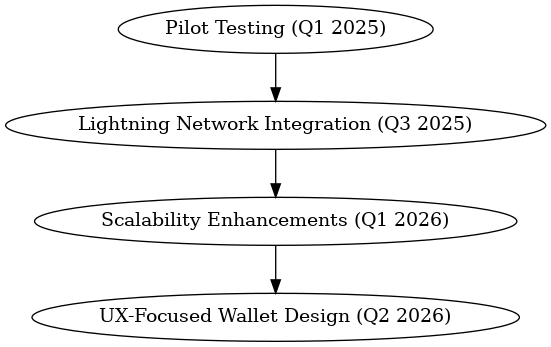

Figure 5: Technological Roadmap, outlining phases including pilot testing, Lightning Network integration, scalability enhancements, and UX-focused wallet design.

Figure 6: Compliance Process Flowchart, detailing KYC/AML steps, referencing BitLicense, FinCEN, and MiCA frameworks.

Risk Analysis and Management

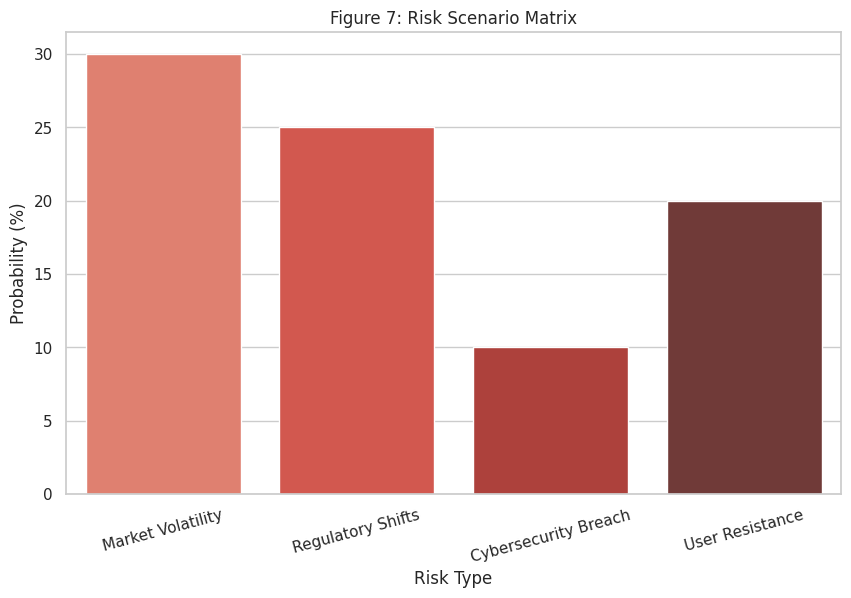

Bitcoin integration involves risks, including market volatility, regulatory shifts, cybersecurity threats, and user adoption barriers. To mitigate volatility, X will explore stablecoin options like PYUSD, stabilizing transaction values. Regulatory risks will be addressed through ongoing dialogue with bodies like the SEC, FinCEN, and MiCA authorities.

Cybersecurity risks, such as wallet hacks or phishing, will be countered with multi-factor authentication and advanced fraud detection. User skepticism, particularly among crypto novices, will be addressed through educational campaigns and transparent risk disclosures. Contingency plans will ensure rapid responses to market disruptions or technical issues.

Figure 7: Risk Scenario Matrix, detailing risks (e.g., 10% probability of a major hack, 20% chance of user resistance) and mitigations like encryption upgrades and user education.

A Unique Competitive Edge

Bitcoin integration positions X uniquely within the fintech landscape, combining its vast user base with innovative financial services. Features like instant tipping, microtransactions, and creator monetization differentiate X from competitors. Synergies with Musk’s ecosystem—such as purchasing Tesla vehicles via Bitcoin on X—further enhance engagement and revenue.

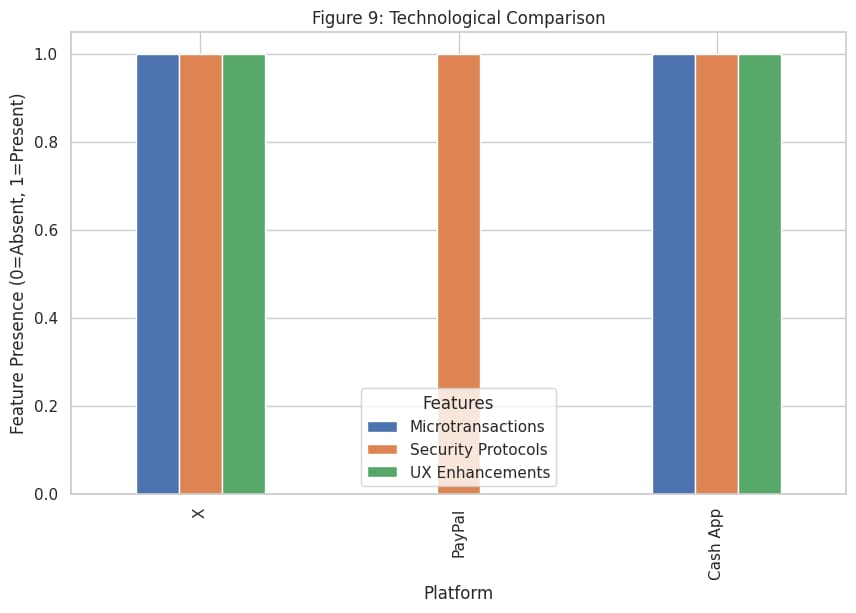

Figure 8: Competitive Comparison Table, highlighting X’s superior user base (600M+), Lightning Network integration, and social-financial features compared to PayPal and Cash App.

Figure 9: Technological Comparison, emphasizing X’s unique UX enhancements, microtransaction capabilities, and security protocols.

Strengthening Social Engagement

Bitcoin integration will enhance user engagement, particularly for content creators and younger demographics. Micropayments and tipping enable frictionless monetization, especially in regions with limited financial infrastructure. For example, a teenage creator in Nigeria could earn Bitcoin tips from global followers, bypassing banking restrictions.

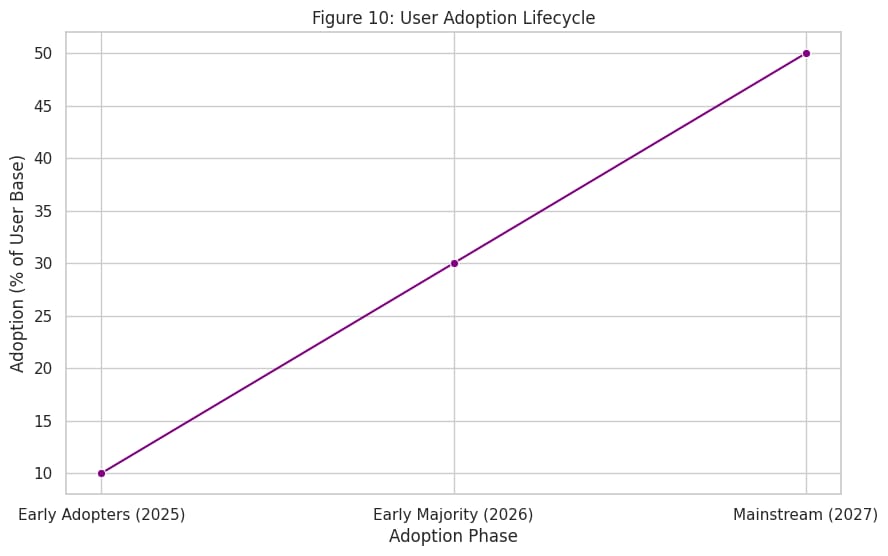

Figure 10: User Adoption Lifecycle Graph, showing adoption phases from early adopters (10% of users) to mainstream (50%+) over three years, with engagement milestones like tipping feature rollouts.

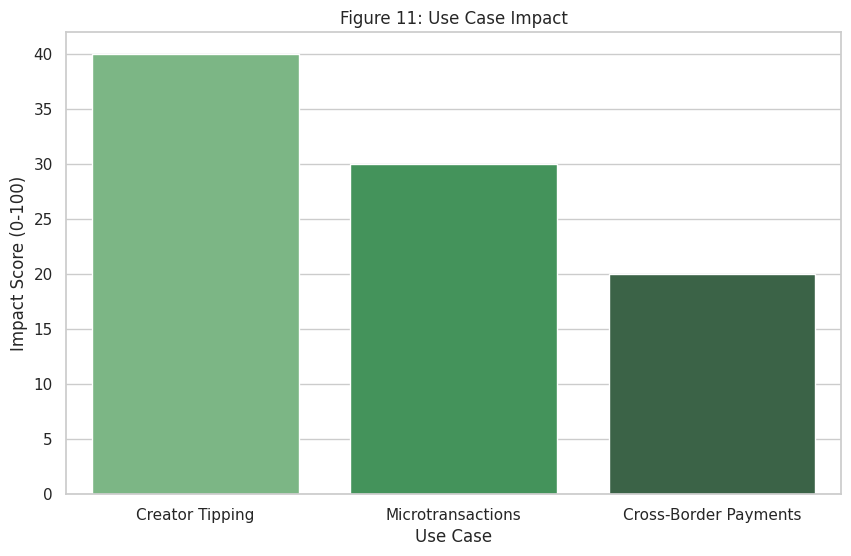

Figure 11: Use Case Infographic, illustrating scenarios like creator tipping, microtransactions, and cross-border payments.

X will ensure trust through robust security, fraud detection, and user education, fostering a reliable environment for sustained engagement.

Conclusion: Shaping the Future

Key Themes:

· Pioneering the convergence of digital finance and social media.

· Building a globally inclusive and accessible ecosystem.

· Securing a competitive edge through innovation and strategic foresight.

X’s integration of Bitcoin represents a bold step toward redefining the intersection of social media and financial empowerment. By leveraging cutting-edge technologies like the Lightning Network, custodial wallets, and scalable infrastructure, X is poised to unlock new economic opportunities for content creators, unbanked communities, and younger demographics worldwide. Through meticulous regulatory compliance and robust risk management, X ensures a secure and trusted platform that fosters vibrant user engagement.

This strategic initiative is more than a technological advancement—it is a commitment to a more connected, equitable digital future. As X pioneers this convergence, it sets a new standard for how platforms can empower users, bridge economic divides, and drive global cryptocurrency adoption. By embracing this vision, X not only positions itself as a leader in the fintech-social media landscape but also catalyzes a broader movement toward financial inclusion and innovation.

Call to Action: Stakeholders, developers, and users are invited to join X in this transformative journey. Together, we can build a platform that not only redefines digital engagement but also empowers millions to participate in a decentralized, inclusive economy. The future of finance is here—let’s shape it with X.

Figure 12: System Architecture Diagram, depicting Bitcoin nodes, Lightning Network, custodial wallets, and user interfaces within X’s technical framework, illustrating the robust foundation for this visionary integration.

Key Takeaways:

• Bitcoin integration establishes X as a trailblazer in fintech and social media

convergence.

• Strategic compliance and user-centric design ensure secure, inclusive experiences.

• Collaborative innovation drives long-term competitiveness and global impact.

Through bold vision, strategic execution, and a commitment to inclusivity, X’s Bitcoin integration is set to reshape the global digital landscape, fostering a future where financial empowerment and social connectivity are seamlessly intertwined.

Erasmus Cromwell-Smith

May 2nd. 2025.

Sources:

Regulatory and Compliance Sources:

U.S. Securities and Exchange Commission (SEC)

Framework for 'Investment Contract' Analysis of Digital Assets

Financial Crimes Enforcement Network (FinCEN)

FinCEN Guidance on Virtual Currencies

Markets in Crypto-Assets Regulation (MiCA)

Bitcoin Adoption and Transaction Volume Data:

CoinMarketCap

Bitcoin Historical Trading Volume Data

Blockchain.com

Bitcoin Transaction Volume Data

Chainalysis

Global Crypto Adoption Index

Technology and Lightning Network Integration:

Lightning Network Official Website

Cash App's Bitcoin Integration

Cash App Bitcoin Features

PayPal Cryptocurrency Integration

PayPal Cryptocurrency & PYUSD Information

User Base and Social Media Integration Data:

X (formerly Twitter)

Twitter User Statistics and Revenue Reports

Statista

Global Social Media User Statistics

eMarketer Reports

Social Media Trends and Adoption Rates

Economic and Financial Inclusion Insights:

World Bank

International Monetary Fund (IMF)

IMF Fintech and Financial Inclusion Reports

Global System for Mobile Communications (GSMA)

GSMA Mobile Money Reports

Risk Management and Cybersecurity:

National Institute of Standards and Technology (NIST)

European Union Agency for Cybersecurity (ENISA)

Case Studies and Benchmarking:

McKinsey & Company

Blockchain and Cryptocurrency Reports

Boston Consulting Group (BCG)

Digital Payments and Blockchain Insights

Harvard Business Review