Introduction

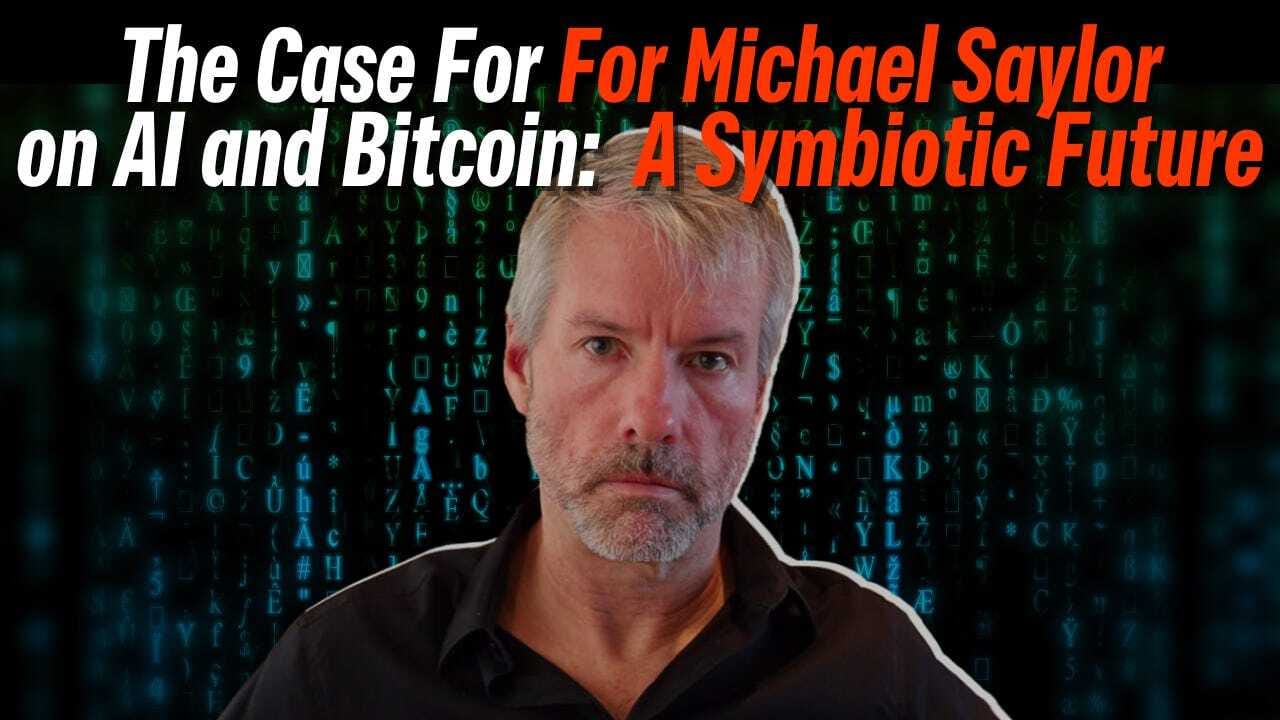

Companies like Microsoft, Google, Amazon, and Meta have collectively invested more than $1 trillion into artificial intelligence technology and development, underscoring AI's rapidly growing significance across industries. With AI-driven revenues projected to surpass $126 billion in 2025 alone, the financial and technological landscape is undergoing transformative shifts. Within this context, The Executive Chairman of MicroStrategy (now "Strategy") Michael Saylor’s insights highlight how AI’s explosive growth could significantly propel Bitcoin adoption, setting the stage for a powerful synergy between these two groundbreaking technologies.FF

Figure 1: Investment Trends in AI (2020–2025): This bar chart depicts the rapid increase in AI investments by leading companies, surpassing $1 trillion by 2025, highlighting the significant acceleration in technological funding.Saylor’s Vision: AI and Bitcoin Symbiosis.

Saylor frequently discusses how artificial intelligence (AI) intersects with Bitcoin’s future. In recent statements (2024–2025), Saylor portrays AI and Bitcoin as complementary forces. He argues that AI’s rise will accelerate Bitcoin adoption by creating new wealth and use-cases. This report examines Saylor’s statements, analyzes his views on AI's influence on BTC adoption, and considers technological, economic, and social dimensions. It also includes supportive and critical viewpoints from other crypto and AI experts.

However, integrating AI with Bitcoin presents a significant challenge: technological scalability, competitive dynamics from other digital currencies, and potential macroeconomic fluctuations could complicate this envisioned symbiosis.

Recent Statements on AI and Bitcoin (2024–2025)

Michael Saylor has explicitly linked artificial intelligence to Bitcoin through several interviews, tweets, and public statements during 2024–2025:

"AI is going to create enormous amounts of wealth and Bitcoin is going to protect that wealth." In June 2024, echoing investor Anthony Pompliano, Saylor highlighted how AI-driven productivity and economic output would generate vast wealth requiring a secure store of value. Bitcoin, he asserted, is the logical asset to protect AI-generated wealth.

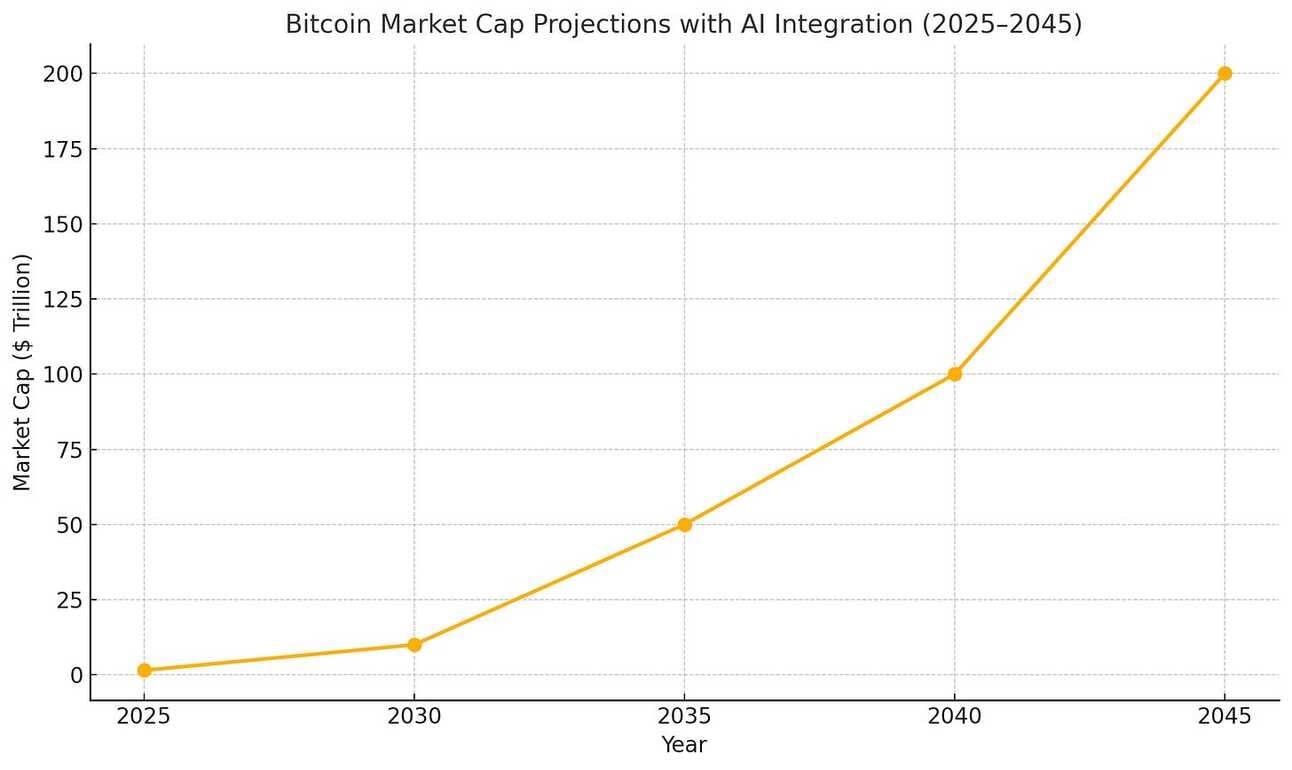

"AI prefers Bitcoin." On July 9, 2024, Saylor tweeted: "AI prefers #Bitcoin." This brief yet provocative statement suggested AI systems would favor Bitcoin over other assets in economic decision-making. It sparked considerable debate, with some in the crypto community concurring that rational AI agents would choose Bitcoin’s inherent qualities, while skeptics expressed doubt. Although not elaborated within the tweet, this aligned with Saylor’s broader narrative positioning Bitcoin as AI’s future currency.

Bitcoin as the "center of the AI economy." In late 2024, during an interview with Al Arabiya English’s Hadley Gamble, Saylor stated that Bitcoin is fundamental to the emerging AI-driven economy. He urged tech-forward Gulf nations to accumulate Bitcoin as a strategic asset, envisioning regional banks as trusted custodians in a digital economy increasingly managed by AI agents.

"The digital economy fused with AI will need Bitcoin." Expanding further, Saylor explained the necessity of Bitcoin within an AI-integrated financial system. He foresaw that in an AI-driven future, "your AI will want to move your money for better investment opportunities 18 million times an hour." According to Saylor, only Bitcoin, with its digital, frictionless monetary network, can adequately support rapid, automated value transfers, surpassing traditional financial systems. Thus, Bitcoin becomes indispensable for an intelligent economy.

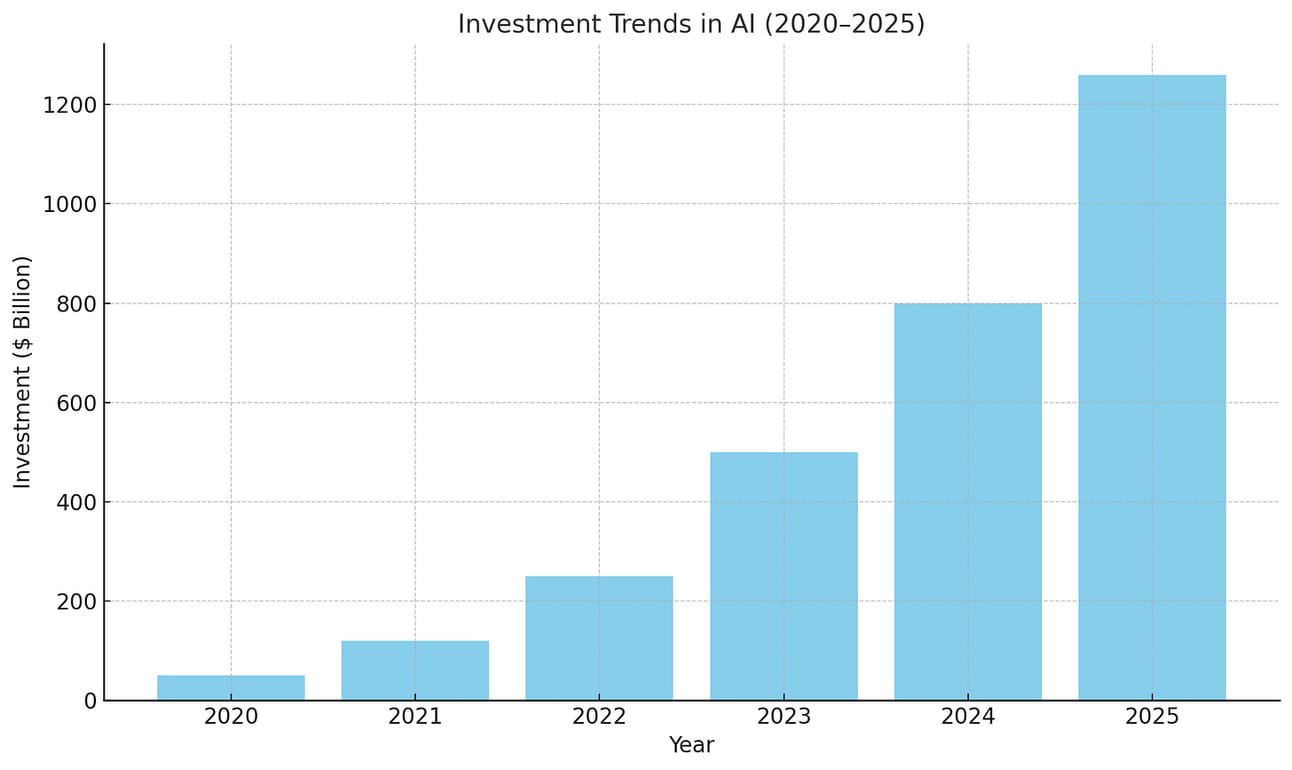

Figure 2: Bitcoin Market Cap Projections with AI Integration (2025–2045): This line chart illustrates the projected growth in Bitcoin's market capitalization, reaching up to $200 trillion by 2045, emphasizing the anticipated impact of AI-driven adoption.

Infrastructure and Scalability

Saylor implicitly acknowledges the need for Bitcoin to manage enormous transaction throughput. He frequently references innovations like the Lightning Network, enabling instantaneous Bitcoin transactions by settling millions of low-value trades off-chain and batching them. This capability is crucial if millions of AI interactions per second are to utilize Bitcoin effectively. Saylor’s company has actively promoted Bitcoin adoption at an enterprise level, noting that AI advancements (such as their "Strategy Mosaic" AI analytics platform) complement Bitcoin integration. He envisions Bitcoin’s technology evolving alongside AI, meeting real-time speed and volume demands.

Figure 3: AI-Bitcoin Synergy Diagram: This infographic illustrates AI-driven wealth creation funneling into Bitcoin as a secure store of value. Key milestones from 2024 to 2045 are highlighted along a timeline, emphasizing Bitcoin’s evolving role in protecting AI-generated prosperity.

Economic Dimensions: Wealth, Productivity, and Value Storage

Saylor addresses how AI reshapes Bitcoin's economic adoption, emphasizing AI's proliferation as a significant driver for Bitcoin's role as a robust store of value:

AI-driven Wealth and Bitcoin Demand: AI’s capacity to dramatically enhance productivity could substantially elevate global GDP. Saylor and Pompliano highlight this "huge tailwind" of wealth creation, projecting significant capital inflows into Bitcoin. "AI is going to create enormous amounts of wealth, and Bitcoin is going to protect that wealth," Saylor asserts, suggesting increased AI-generated prosperity will gravitate towards inflation-proof assets. Bitcoin, with its deflationary and secure characteristics, becomes an optimal candidate, outcompeting traditional assets like gold or fiat savings. Consequently, Bitcoin adoption as a universal savings mechanism could accelerate rapidly.

Neutrality and Trust in Currency Choice: Saylor underscores Bitcoin’s non-sovereign, inflation-resistant nature as essential to its appeal in a global AI-driven economy. AI agents operating without national allegiance and transacting across borders require a neutral currency. Bitcoin’s decentralized verification and fixed supply make it an ideal base money for AI, amplifying its economic value for holders. In Saylor’s 2045 vision, Bitcoin's market capitalization surpasses $200 trillion as both human and AI economies rely on it for final settlement, vastly expanding its adoption.

Feedback Loop of Adoption: Saylor describes a positive feedback loop between AI-driven efficiencies and Bitcoin adoption. Increased corporate profits and personal incomes resulting from AI innovations encourage entities to seek Bitcoin for wealth preservation. This legitimacy spurs broader institutional and governmental acceptance. Saylor cites potential scenarios, such as the U.S. government significantly investing in Bitcoin, as pivotal events that could trigger widespread international adoption. AI’s economic influence thus becomes a critical catalyst, driving essential digital strategies integrating Bitcoin and AI to remain competitive.

Saylor views AI’s economic expansion as directly facilitating Bitcoin’s accelerated adoption across diverse societal segments, from individuals to large institutions.

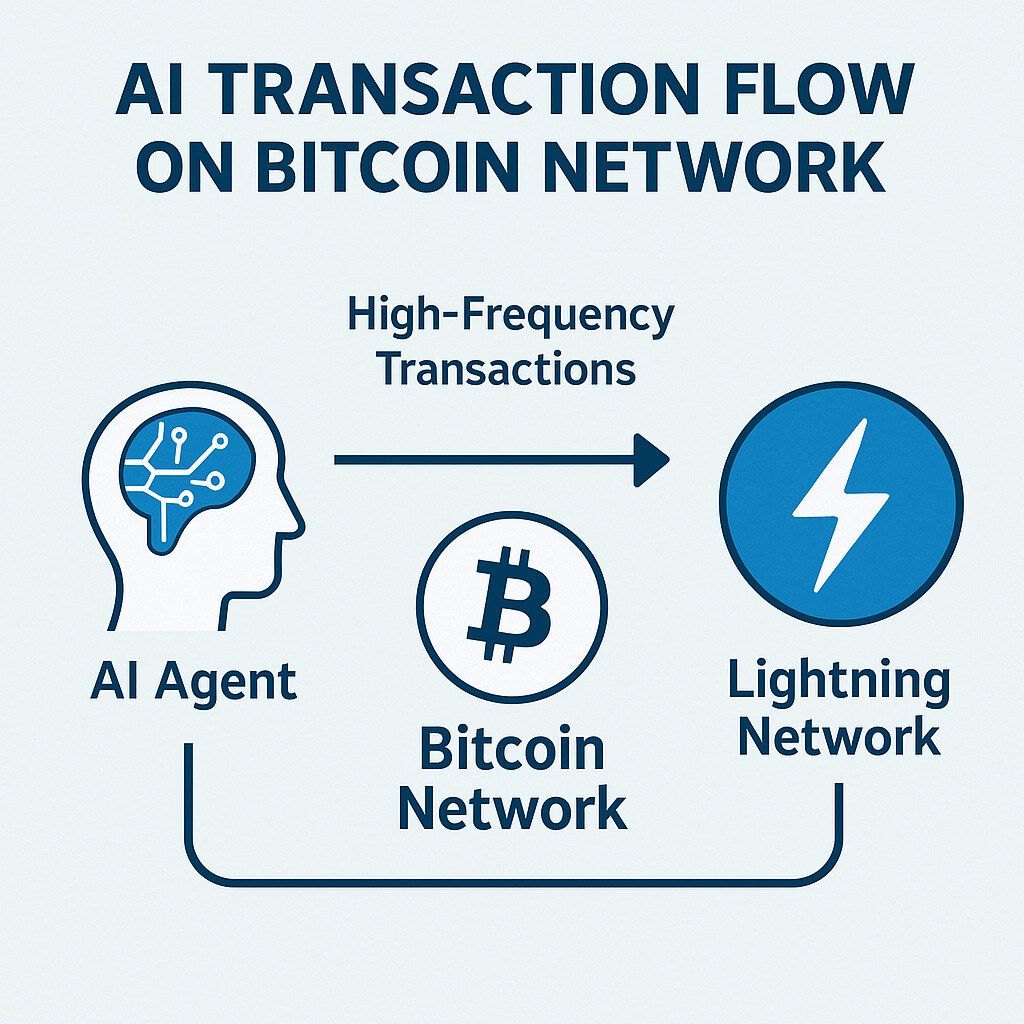

Figure 4: AI Transaction Flow on Bitcoin Network: This visualization demonstrates how AI agents conduct high-frequency transactions on the Bitcoin network using the Lightning Network. It highlights scalability and rapid transaction speeds essential for machine-to-machine economic interactions.

Beyond technological and economic dimensions, Saylor highlights critical social and behavioral aspects through which AI influences Bitcoin adoption:

AI Shaping Investor Behavior: With AI tools becoming commonplace, investment decisions could increasingly depend on rational analyses provided by AI-powered advisors. Saylor implies that unbiased, data-driven AI analysis would naturally highlight Bitcoin’s strengths. Parsing extensive market data, an AI might conclude that Bitcoin’s risk-reward balance and resistance to fiat currency debasement make it a prudent investment choice. Saylor’s phrase "AI prefers Bitcoin" suggests that an impartial intelligence would favor Bitcoin, potentially driving more informed, widespread adoption among diverse demographics.

Cultural Convergence of AI and Crypto: Saylor identifies Bitcoin and AI as the transformative trends of this century, strategically coupling them to tap into popular excitement and cultural momentum surrounding AI. Although early 2023 saw AI overshadow crypto briefly, Saylor’s narrative effectively binds their futures together. He uses contemporary AI tools to engage the public—for example, an AI-generated video released in 2025 featured a child version of himself advocating Bitcoin’s benefits, humorously asserting it is "going up forever!" Such creative uses of AI-generated media to promote Bitcoin help to socially amplify advocacy, making Bitcoin more accessible, engaging, and relatable to broader audiences.

Trust in a Decentralized Era: The rise of AI raises substantial societal questions about trust and control. Saylor positions Bitcoin as an essential anchor of trust within an increasingly complex digital landscape. Amidst diminishing public confidence in traditional institutions—due to inflation, banking crises, or other disruptions—Bitcoin’s decentralized, transparent structure offers a reassuring alternative. AI-induced job displacements or societal shifts may encourage individuals to gravitate toward Bitcoin as a means of maintaining financial sovereignty and personal empowerment. Thus, Bitcoin adoption becomes not merely an investment strategy but also a crucial form of security and autonomy in a rapidly transforming AI-driven world.

In essence, Michael Saylor envisages AI significantly accelerating Bitcoin adoption through technological necessity, economic opportunity, and evolving social attitudes. He predicts a mutually reinforcing relationship where AI and Bitcoin jointly reshape industries and everyday life.

Figure 5: The 2045 AI Economy Landscape: A futuristic scenario of the 2045 economy, where AI agents interact and transact financially via Bitcoin. The visualization captures machine-to-machine transactions, decentralized networks, and Bitcoin's central role as a universal settlement currency.

Other Expert Opinions: Support and Counterpoints

Michael Saylor's perspective resonates widely among crypto and technology experts, although there are critical viewpoints and alternative considerations worth examining:

Anthony Pompliano (Venture Investor): Pompliano agrees that AI and Bitcoin will synergize effectively over the next decade. He argues against the idea that AI might eclipse cryptocurrencies, emphasizing instead AI-driven productivity boosting GDP, with Bitcoin serving as the preferred wealth preservation asset. Pompliano's perspective aligns closely with Saylor’s, emphasizing Bitcoin as the inevitable monetary choice for machine-driven economies.

David Marcus (Lightspark CEO, Former Meta Executive): Marcus strongly supports Bitcoin’s potential as the native currency for AI-driven economic activity. Speaking at Saylor’s 2024 Bitcoin for Corporations event, Marcus emphasized the critical role of Bitcoin’s Lightning Network in facilitating real-time micro-transactions among AI agents. Marcus asserts, "If Bitcoin transactions become efficient and instantaneous at AI transaction speeds, Bitcoin naturally becomes the preferred currency for AI." He projects that AI systems will use Bitcoin's neutral digital nature for settlements, affirming Bitcoin's role as the default monetary infrastructure for automated commerce. Marcus’s practical perspective on Lightning Network technology aligns significantly with Saylor's vision, further emphasizing Bitcoin’s unique attributes beneficial to AI interactions.

Industry Reports (ARK Invest, etc.): Investment research from entities like ARK Invest also echoes Saylor’s optimism, underscoring AI as a catalyst for substantial long-term Bitcoin appreciation. ARK analysts foresee scenarios where AI entities maintain Bitcoin reserves, significantly elevating demand and contributing to a multi-trillion-dollar Bitcoin valuation by 2030–2040. Such projections align closely with Saylor's bullish forecasts, highlighting machine micro-transactions and AI-managed investment funds as emergent sources of Bitcoin demand.

Joe Lonsdale (Tech Entrepreneur): Joe Lonsdale has publicly supported the notion of AI systems leveraging cryptocurrencies, particularly Bitcoin, for coordinating tasks and facilitating transactions. Lonsdale suggests that AI agents' engagement in Bitcoin markets introduces a novel adoption channel, potentially integrating billions of automated demand points for Bitcoin. His stance corroborates Saylor’s assertion that the emergence of AI as an active market participant could significantly boost Bitcoin adoption rates.

Despite widespread optimism, some critical counterpoints and alternative viewpoints exist:

Competition from Other Currencies: Critics argue that AI systems might prefer stablecoins or central bank digital currencies (CBDCs) for transactional activities due to their reduced volatility. For routine commerce, stable, dollar-pegged tokens might offer more predictability, potentially limiting Bitcoin's role to settlement or long-term savings. David Marcus himself acknowledges this possibility, suggesting a scenario where AI agents transact in Bitcoin’s smallest units (sats) on Lightning Network but convert to fiat currency when necessary. This viewpoint presents a nuanced perspective, highlighting Bitcoin's potential dominance in specific roles rather than universal currency usage.

Technological Hurdles: Skeptics highlight significant technological challenges that Bitcoin must overcome to fully accommodate AI-scale demands, including robust scalability and network efficiency. AI-driven high-frequency trading and machine-to-machine micropayments necessitate extensive adoption of advanced scaling solutions like Lightning Network, sidechains, or further throughput enhancements. Competing blockchain initiatives, such as Fetch.ai or Render, also target AI-specific use cases, suggesting potential competition. Saylor counters by emphasizing Bitcoin’s superior security, liquidity, and ongoing innovation, asserting that layer-2 solutions adequately address these challenges.

Macro Trends and Hype Cycles: Analysts caution that linking AI directly to Bitcoin’s success could be overly optimistic or hype-driven. Observers point to early 2023, when AI attracted significant investment, occasionally overshadowing crypto. Should AI advancements stagnate due to regulatory hurdles or if major benefits accrue primarily to large tech corporations rather than decentralized networks, Bitcoin may not experience anticipated direct gains. Additionally, AI introduces potential cybersecurity risks—advanced AI might theoretically challenge cryptographic security or be exploited for cyberattacks on crypto infrastructure. Saylor tends not to emphasize these potential drawbacks publicly, instead focusing on Bitcoin’s independent momentum driven by monetary fundamentals. Critics argue, however, for cautious consideration, suggesting Bitcoin’s path involves broader geopolitical and economic factors beyond AI-driven influences alone.

In weighing these diverse expert opinions, it becomes clear that while many within the crypto community share Saylor’s optimistic vision of AI and Bitcoin synergy, significant practical challenges and competition exist. Assumptions like universal AI preference for Bitcoin depend heavily on evolving technological capabilities, regulatory frameworks, and broader economic contexts.

Conclusion

Michael Saylor’s recent commentary positions artificial intelligence and Bitcoin as intricately connected, mutually amplifying their respective impacts. He envisions AI-generated wealth flowing into Bitcoin as a secure haven, AI agents choosing Bitcoin as their preferred transaction medium, and an emergent "AI economy" that elevates Bitcoin as a global standard for settlements. Combining technological foresight, economic rationale, and futuristic optimism, Saylor's thesis asserts Bitcoin as the foundational financial infrastructure for the era of intelligent machines.

According to Saylor, Bitcoin's neutrality, scarcity, and robust security uniquely qualify it as the primary choice for value storage and exchange, appealing to both human and AI participants. If his thesis proves accurate, AI-driven expansion could dramatically accelerate global Bitcoin adoption, potentially achieving Saylor’s ambitious projections by mid-century.

Yet, expert consensus acknowledges practical challenges—like scalability, competing digital currencies, and technological hurdles—that could moderate Bitcoin’s role. While AI and blockchain technologies are expected to co-evolve significantly, the precise dynamics of their integration remain uncertain.

As of 2025, Saylor continues actively promoting this interconnected vision at global conferences and through extensive media engagement. He consistently urges corporations, policymakers, and individual investors to recognize Bitcoin's integral role in a future dominated by artificial intelligence.

Ultimately, Michael Saylor’s forward-looking assertions articulate a bold narrative: rather than sidelining Bitcoin, artificial intelligence stands poised to serve as a powerful catalyst for its widespread global adoption. Whether the future unfolds exactly as envisioned by Saylor remains uncertain, but the intersection of AI and Bitcoin unquestionably represents a critical area of focus for investors, technologists, and regulators alike in the coming years, with Saylor firmly positioned as a prominent advocate and thought leader.

Erasmus Cromwell-Smith

May 2025

@CromwellErasmus

Sources:

cointelegraph.com

tradingview.com

laraontheblock.com

coindesk.com

cryptorank.io t

okenpost.com

nasdaq.com

strategysoftware.com

cnbc.com

benzinga.com

linkedin.com

blockchain.news

Social Dimensions: Perception, Trust, and Human-AI Interaction