💰 BlackRock Earns More From Its Bitcoin ETF Than Any Other Fund

BlackRock’s Bitcoin ETF is now generating more revenue than any other ETF in its lineup, a striking milestone for an asset Wall Street once dismissed outright.

The significance isn’t just inflows, it’s incentive alignment. Bitcoin exposure is no longer ideological for institutions like BlackRock; it’s simply good business.

⚠️ Binance Sees Brief $24K Bitcoin Flash Crash on Christmas

Bitcoin briefly wicked down near $24,000 on Binance during thin holiday liquidity, triggering liquidations and panic across trading desks.

The move was sharp but short-lived, underscoring how fragile leveraged markets can be when liquidity dries up, and how quickly price can snap back when forced selling exhausts itself.

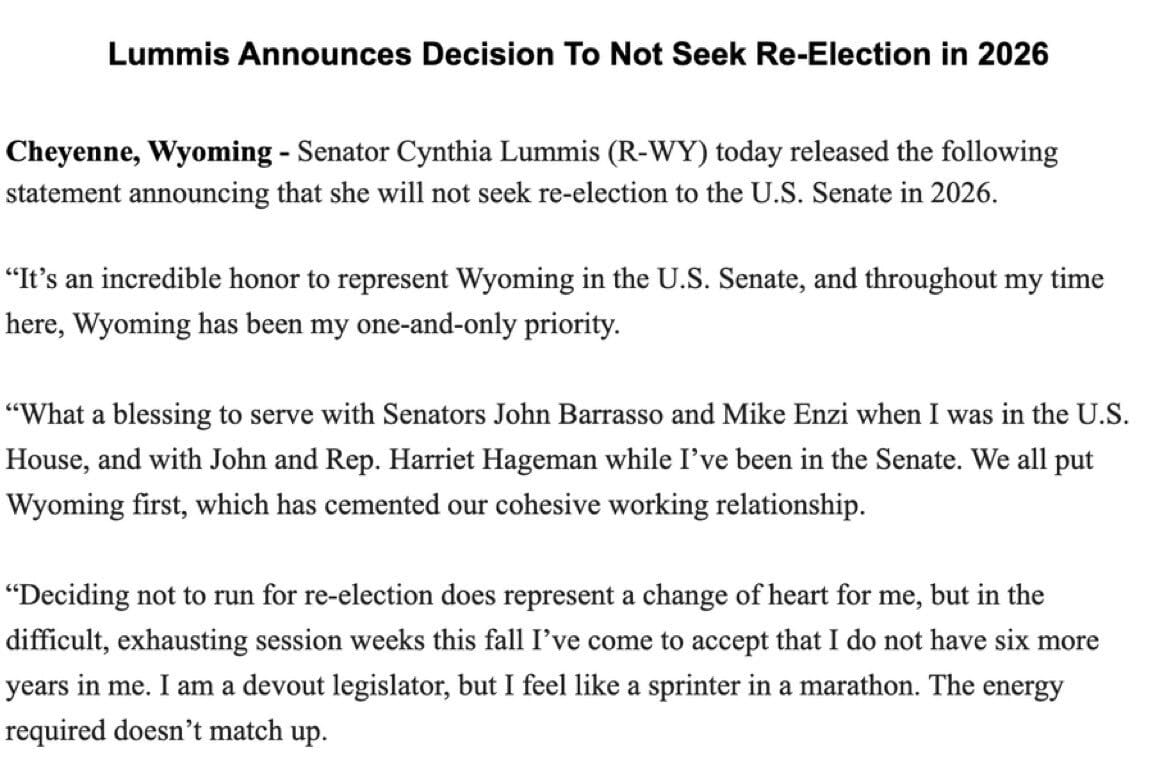

🏛️ Senator Cynthia Lummis Will Not Seek Re-Election

Senator Cynthia Lummis announced she will not run for re-election, marking the eventual exit of one of Bitcoin’s earliest and most vocal champions in Washington.

Her departure creates uncertainty over whether the U.S will actually buy bitcoin, but also highlights how far the conversation has moved. Bitcoin advocacy is no longer dependent on a single voice.

⚖️ Pro-Bitcoin Michael Selig Confirmed as CFTC Chair

Michael Selig, widely viewed as a pro-Bitcoin and market-structure-focused regulator, has been confirmed as Chair of the CFTC.

This appointment signals a potential shift away from regulation-by-enforcement and toward clearer rules for digital commodities, a long-standing demand from the industry.

🏦 Christine Lagarde Slips CBDC Messaging Into Holiday Address

During a Christmas message framed around unity and stability, ECB President Christine Lagarde subtly reinforced the case for a central bank digital currency.

The contrast was hard to miss: while institutions profit from Bitcoin and users adopt it voluntarily, central planners continue pushing programmable money under softer branding.

VIDEO OF THE WEEK

Bitcoin’s been acting weird, stuck between $85K–$90K with no real breakout. But buried in a recent institutional leak is the real reason: options dealers and Wall Street are suppressing the price, until December 26. This breakdown reveals the $23B gamma event that could send Bitcoin soaring.